About the research

The Confederation of British Industry (CBI) carried out a study into why variations in productivity and growth exist across the regions and nations of the UK, and investigate what businesses and government can do to tackle them. The research and analytical support from McKinsey & Company informed the CBI ‘Unlocking Regional Growth’ report which was launched at the Manufacturing Technology Centre in Coventry, sponsored by Irwin Mitchell, and is the product of extensive analysis and engagement with members across the UK.

In her opening foreword to ‘Unlocking Regional Growth’, Director-General of CBI, Carolyn Fairbairn notes that the “most productive area of the UK is now almost three times more productive than the least”. This is quite a staggering statistic, and highlights the disparities in performance among UK regions, cities and other localities. CBI set out to produce a rigorous database of the drivers of productivity, using ONS data to build a productivity map of the UK and to understand the strengths and weaknesses of each geographical location.

The report, published in December 2016, highlights four main drivers of regional productivity differences, which span across education, infrastructure management and exportation/innovation. CBI has also calculated what the economic impact could be by 2024, if each local area could improve at the same rate as the top performer in their respective region or nation, which they believe could total £208bn. In addition to these key findings, three main recommendations have been made for central and local government and business leaders, focussing on devolution, a well-designed Industrial Strategy and continued investment across the four key drivers identified.

Methodology

With input from McKinsey & Company, CBI have produced a number of analyses using ONS data from; Business Structure Database (BSD), Annual Survey of Hours and Earnings (ASHE), Business Enterprise Research and Development (BERD) and E-Commerce. ONS also provided data from the National Employer Skills Survey (NESS) supplied by the UK Commission for Employment and Skills (UKCES) and the Community Innovation Survey (CIS) supplied by the Department for Business, Energy and Industrial Strategy (BEIS).

For their analysis, the researchers accessed the data in the Secure Research Service (SRS) (formerly known as the Virtual Microdata Laboratory), a secure environment in which analyses can be carried out on de-identified record level data, at a more granular level. This level of granularity is what sets this report apart from previous literature on regional growth, which has focussed on higher level data (NUTS1; Scotland, Northern Ireland, Cymru Wales and 9 regions in England). With the use of ONS data, CBI and McKinsey & Company produced analyses on 173 geographic locations (NUTS3). In addition to these analyses, CBI established a panel of experts on regional growth to peer review their methodology, and gained practical advice from senior business leaders.

Prior to undertaking analysis, a core database was created by matching three datasets together; Annual Respondents Database X (ARDx), Business Register and Employment Survey (BRES) and BSD. The statistical methods used to analyse the data used can be considered as four main activities as outlined below.

- Aggregate firm characteristics were summarised, such as demographic, behaviour and performance in each geographic location, which helped to provide a fact-base to inform the detailed hypothesis of further testing.

- Additional analysis on these characteristics was then carried out to better understand their dispersion across the UK, offering insight into areas of high or low concentrations and what location specific factors or influences may be at work.

- During the next stage, a number of regression analyses were specified and tested to highlight where performance can be expressed as a function of other variables and to shine a light on any positive or negative relationships.

- Lastly, a summary of performance for each geographic location has been produced relative to the underlying potential, to understand whether the area is performing as predicted, given the identified regressions. Analysis on any deviation from the predicted value was conducted to understand the possible causes.

Research findings

The ‘Unlocking Regional Growth’ report provides some very interesting statistics which highlight the vast disparities of productivity throughout the UK. The findings include:

- Productivity varies just as much in a region, as it does between a region

- Most productive area of UK now three times more productive than the least

- An economy that could be £208 billion larger, if each local area could improve at the same rate as the top performer in their respective region or nation.

The report finds that there are four main drivers of regional productivity differences;

- transport links that widen access to labour

- better management practices

- a higher proportion of firms who export and innovate

- educational attainment of young people at 16 and skills, which has been identified as the single most important driver of productivity differences around the UK

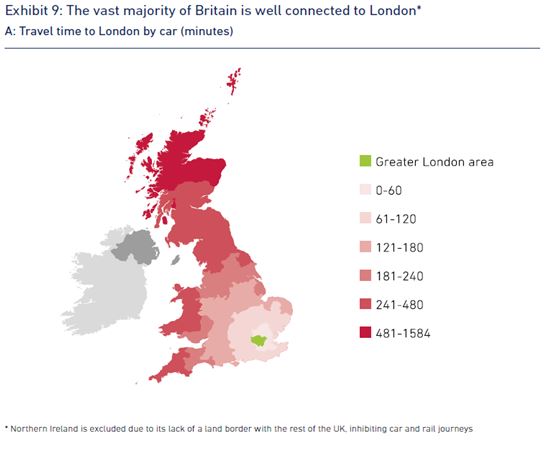

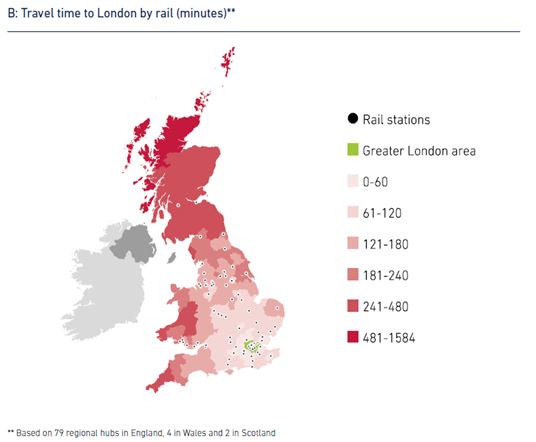

Outside of London, travel times between major cities, regions and nations are relatively poor. CBI has found that businesses are particularly frustrated by the lack of good transport links, especially in the North and in areas of high congestion such as the South East and Thames Valley. Using evidence from commuting patterns, most people travel for a maximum of one hour to work, so minimising travel times is important for widening the talent pool and improving productivity. CBI has estimated that reducing travel times by road could increase productivity by up to 14%.

The research shows that more productive regions often have a greater proportion of firms offering management training. Better management practices and management tools that align with productivity have also been found to perform better, with results also suggesting that firms offering performance related bonuses and flexible benefits tend to be more productive.

CBI has calculated that most regions and nations have between 10% and 15% of firms that could be exporters and believe that providing these firms with the support and initiative to begin exporting, would not only force them to become more competitive but will also encourage innovation and help to produce productivity gains.

The report estimates that only 3% of the working population move to another region in a given year. In addition to this, the people moving out of a region for University rarely return. To enable businesses to drive growth, a focus on people leaving school with the right skills is very important. Likewise, the report also references the UK Employer Skills Survey, by the UK Commission for Education and Skills; that around 90% of people in the workforce today will be in employment in 10 years time, making on the job training and lifelong learning just as crucial.

Impact of the research and findings for policy

CBI believe the findings should provide an evidence base to inform local city deals, for local leaders to test and shape their priorities and spending decisions, and inform policy and service planning decisions for UK regions and nations throughout the years to come.

It is also their aim that central government use the findings from this report to inform the place-based elements of their Industrial Strategy to understand what will bring the most benefit to local communities. In their recommendations, CBI notes that “the government should look to extend infrastructure funding both within and between regions where the agglomeration (location connection) benefits of investing in local transport infrastructure clearly outweigh the costs.” Their recommendation is that this be addressed within the pre and post 2020 Road Investment Strategy and the next rail investment period.

CBI articulates that it is important that government focus on education, particularly around long-term outcomes and greater careers support to help students better prepare for the world of work. The research recommends an enhanced role for regional Schools Commissioners in providing greater support for underperforming schools. Education should continue long into the workplace, with the report suggesting that the UK government and devolved administrations should also increase the voice of local enterprise partnerships and local business groups in articulating skills needed.

CBI and Irwin Mitchell have produced ‘Regional Scorecards’, which are based on NUTS3 geography, and highlight the strengths and weaknesses in each geographic area. These have been made available to business leaders, policymakers and local communities via their website. Alongside the findings from ‘Unlocking Regional Growth’, these scorecards should help foster a long-term approach to increasing the UK’s growth potential.

The report has gathered a lot of interest, most notably from Number 10, the Bank of England and cross party back bench MPs. During 2017, ‘Unlocking Regional Growth’ has been implemented across regions, localities and nations, with dynamic workshops and in-house sessions being offered to engage with stakeholders and regional and local decision makers about what drives productivity at an individual geographic area. Various teaching talks have also been carried out across government, with similar events being held at a regional level across CBI’s business network.

‘Unlocking Regional Growth’ aligns with the CBI’s prosperity agenda and formed the foundation of the CBI’s Industrial Strategy green paper submission earlier in the year. The CBI is now also planning to bring together business leaders, in regions across the UK, to identify early priorities for regional industrial strategies and will continue to work closely with CBI members and stakeholders to ensure alignment with the white paper. Their objective is to provide a forum for CBI members to discuss and help shape local priorities that will boost productivity locally.

The ‘Unlocking Regional Growth’ campaign has also yielded other work like ‘Pursuing Prosperity’ in Scotland and the forthcoming CBI report looking at innovation diffusion.

Read the Report

http://www.cbi.org.uk/insight-and-analysis/unlocking-regional-growth/